“Trade revolves in an established cycle. First we find it in a state of quiescence (inactivity), next improvement, growing confidence, prosperity, excitement, over-trading, convulsion, pressure, stagnation, distress, ending again in quiescence” – Lord Overstone, British Banker and Politician 1837.

More than most cities, Perth is impacted by the cyclical nature of the global economy. The boom/bust cycle is engrained in our economic history, from the gold rush to the “resources boom”. Given the size of the city and population, we are dependent on trade, particularly international trade.

WA is, and will remain, a resources city first and foremost. As outlined, the current resources boom surpassed previous booms in Western Australia. Gorgon is the largest resources project in Australia’s history.

According to the Federal Government, in 2008-2009, the mining sector accounted for 25.3% of WA’s Gross Value Added (a measure of industries’ contribution to the State’s economy). By 2015, its contribution to the state economy was approximately 37% of GVA (Curtin-Bankwest Back to the Future). More than any other State our economic fortunes are tied to one industry.

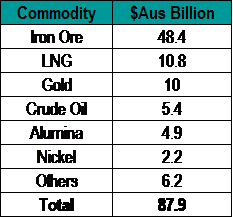

Within the resources industry, iron ore remains our most important commodity accounting for 55% of the value of Western Australian resources industry. WA supplies 37% of the world’s iron ore supply. Oil and Gas are the next largest commodity accounting for 18.4% of the value of the Western Australian resources industry, followed by Gold at 11.4%. Alumina accounts for 5.6%, nickel, 2.5%, and all other resources including diamonds, lithium and Mineral Sands account for just 7.1% of the value of Western Australia’s resources industry.

The chart, shows the value of each commodity in Australian Dollar terms. WA’s economy will remain dependent on the price of iron ore well into the next decade.

Source: Department of State Development WA Mineral and Petroleum Statistics Digest 2015-16.

The growing importance of LNG projects to the State’s economy is reflected in projects currently under construction. The Department of State Development note that in September, 2016, there was $96.9 billion of major resource projects under construction or committed in Western Australia. LNG projects accounted for 91.7% of the value of resources projects under construction. The growth of Lithium mining is shown in the $9.6 billion dollar planned investment in other minerals.

State Government Treasury Forecasts – December 2016

The 2016-17 Mid-Year Budget Financial Projections Statement released in December 2016 make the following forecasts on the West Australian economy:

Gross State Product

- Growth in GSP is forecast to be just 1%. This is down from 9 per cent in 2011-12 and well below the state’s long-term average growth rate of 4.7 per cent. Growth is forecast to improve to 2.25% in 2017/18. Growth is forecast to remain well below average for the balance of the decade.

Unemployment

- Full office buildings are evidence of a robust job market. The current level of office vacancy across metropolitan Perth, over 825,000 sq m (equivalent of over 20 full Woodside Plaza buildings), is reflective of our nation-leading unemployment rate of 6.9%. There are now 95,000 thousand West Australians out of work. The Budget forecast unemployment to remain above 6%. Employment growth is forecast to be negative 1.5% in the current budget year returning to 0.25% growth in 2017/18 as job creation in new sectors is offset by the completion of major LNG projects and weak housing construction figures.

- The headline unemployment rate also masks a growing underemployment problem with the proportion of full time jobs continuing to fall as part time jobs in retail continue to grow. According to the ABS, in November 9.7% of employed people would like to work more hours. Our underemployment rate is at its highest level on record.

- Increasing unemployment and the growth of part time employment is flowing through to weak wages growth. WA’s wage price growth index is forecast to grow by 1.5% in 2016/17, nearly double the 0.8% rate of inflation in WA. Wages growth is forecast to remain below the long-term average of 3.7% per annum across the estimates.

Population Growth

- Western Australia’s population growth continues to slow from the peak of the boom. From a peak of 3.5% growth per annum, WA’s population is forecast to grow by 1.2% in 2016/17.

- In terms of people this represents a fall from 88,000 people to under 30,000.

- Net interstate migration continues to remain negative as people chase employment opportunities in NSW and Victoria. Just under 10,000 West Australians relocated east in the past 12 months. Net overseas migration continues to grow by around 15,000 people per annum.

- WA’s population growth is forecast to increase by only 1.3% in 2017-18, due to current economic conditions deterring overseas and interstate migration to WA with the natural increase being the main driver of growth.

Housing Construction

In October 2016, the State Government, Housing Industry Forecasting Group made the following forecasts on housing construction in WA between 2015 and 2020.

- The 2015-16 commencement figure represents a 19% fall on 2014-15 figures. Weaker housing construction, very limited office and industrial construction, combined with the completion of major resources projects are major issues for the construction sector in 2017.

- Building approvals continue to fall; down to 24,601 in 2015-16. This represents a 24.7% decrease on the record high in the 2014-15 financial year.

- As a result of lower commencements, housing investment is forecast to contract by 9.25% in 2016-17 before growing by 1.5% in 2017/18.

- According to REIWA in March 2016, 15,261 dwellings were on the market in metropolitan Perth; this is up 84.7% from March 2013. The current average number of selling days is 67 compared to a three year low of 49 days.

- The Budget outlines that Total transfer duty grew by 3.4% in 2015-16 compared to an estimated decline of 0.3%. This reversal was due to a number of large commercial transactions including the portfolio sale of the Insurance Commission of WA property assets.

- Removing these large commercial transactions, underlying transfer duty declined by 20.3% in 2015-16. In 2016/17 the underlying Transfer Duty is forecast to fall a further 7.5%. These declines, despite low interest rates, are reflecting weaker sales of residential property as our population growth slows.

No matter who will deliver the next stage Budget, repairing the Budget and creating jobs will be key challenges. The looming March 2017 State Election will play an important role in shaping WA’s economic and property performance.